maricopa county tax lien auction

There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. Detailed listings of foreclosures short sales auction homes land bank properties.

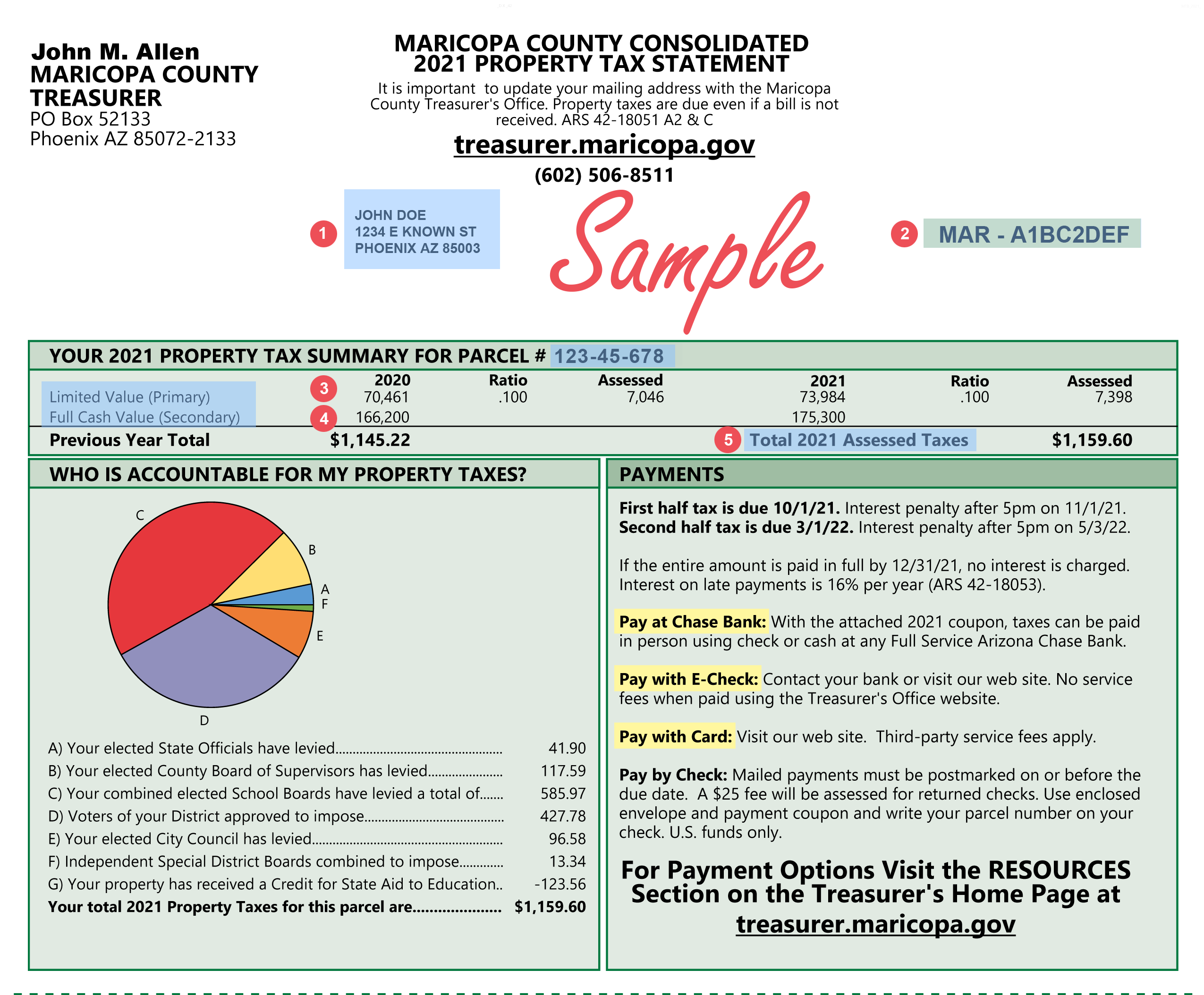

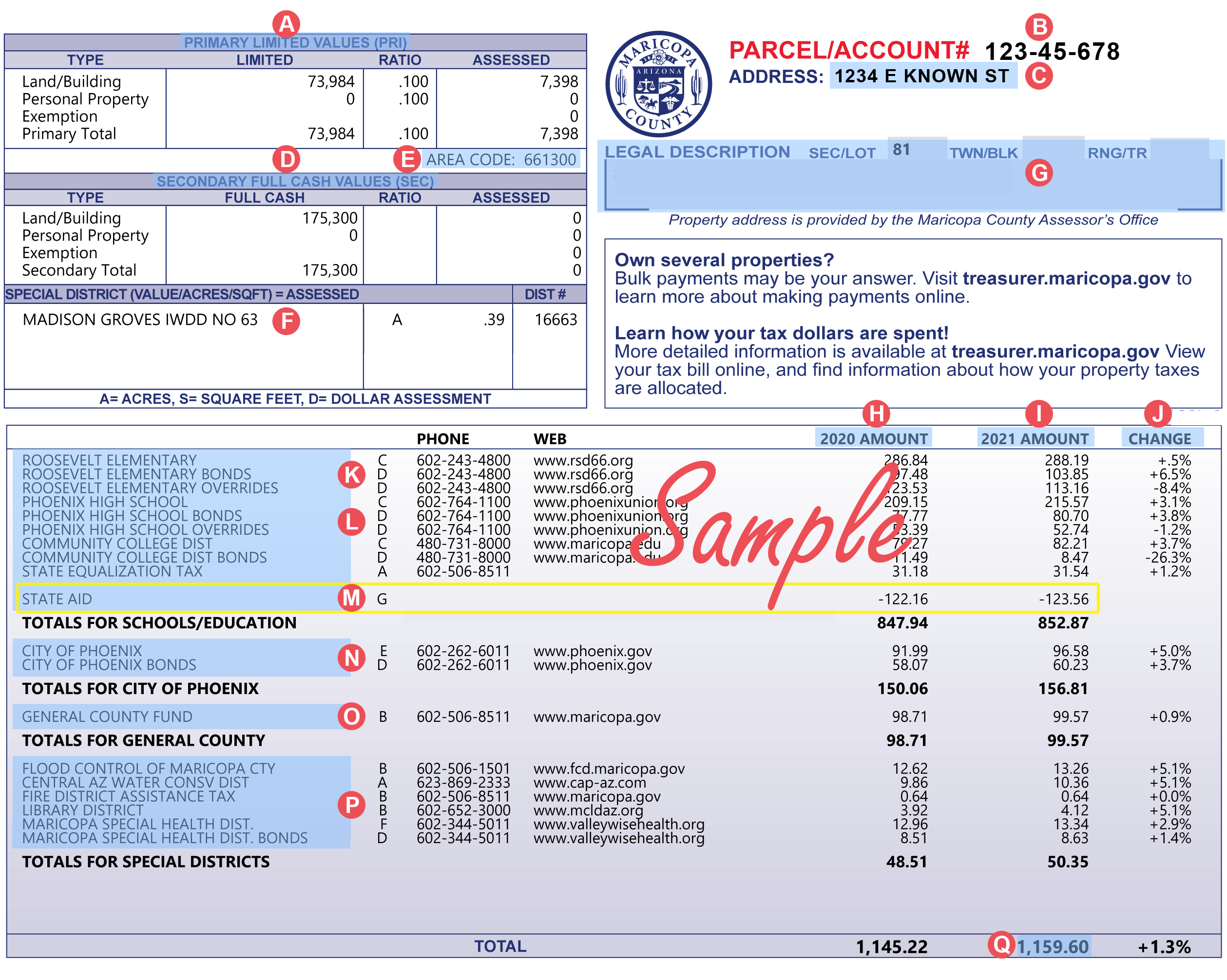

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

These are delinquent real estate taxes which means that you are buying a debt that at the.

. You can now map search browse tax liens. Day of the Online Auction March 2. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with a full cash value.

Maricopa County Assessors Office. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Maricopa County AZ currently has 2496 tax liens available as of December 25.

The Tax Lien Sale will be held on. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. Tax Deeded Land Sales.

The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services. You should know that on certain parcels in addition to the ad valorem taxes offered for a tax lien sale there may be special assessments due that are unknown to the Maricopa County. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

Maricopa County AZ currently has 18086 tax liens available as of August 8. The Tax Lien Auction Each county Treasurer handles the tax lien auction a little differently. Some counties such as Maricopa County Pinal County and Apache County hold.

The county will make a tax delinquent properties for sale list. Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax. Another day another tax sale added - 5 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales.

Get Access to the Largest Online Library of Legal Forms for Any State. CP holders may begin to subtax 2021 liens. State CP sales begin May 2.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Ad Need Property Records For Properties In Maricopa County. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. These listings may be used as a general starting point for your research.

Delinquent and Unsold Parcels. Payment in full with Cash or Certified Funds. Second half 2021 taxes are delinquent after 500 pm.

How do I buy a tax lien in Maricopa County. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the. Download a list of tax liens available for purchase please be patient this may take a while.

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Maricopa County Assessor S Office

News Flash Maricopa County Az Civicengage

Making Sense Of Maricopa County Property Taxes And Valuations

Top Republican Casts Doubt On Plan To Break Up Maricopa County

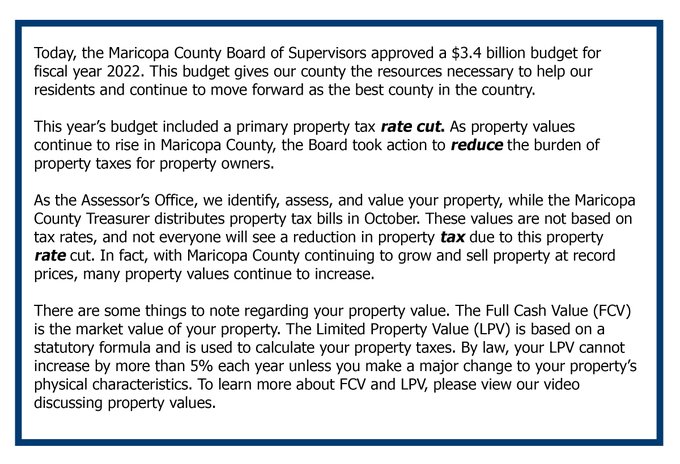

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate

Residential Rentals In Maricopa County Must Be Registered The Arizona Report

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Assessor S Office

Maricopa County Treasurer S Letter Meant As Farewell Not Politics

Making Sense Of Maricopa County Property Taxes And Valuations

Maricopa County Assessor Parcel Viewer Overview

Maricopa County Assessor Eddie Cook And Team Explain Office S Role In Property Taxes Community Impact

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate